How much can i borrow first time mortgage

You can also input your spouses income if you intend to obtain a joint application for the mortgage. How much do you think youll be able to borrow from the bank.

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate.

. While your personal savings goals or spending habits can impact your. Switch to a new rate. You spot a house for sale for 300000 and wonder can you afford it.

Thinking about getting onto the housing ladder. Use our first time buyer calculator to start the journey to your first home. This is calculated at purchase price 300000 multiplied by 90 270000.

As a first time buyer the highest level of mortgage facilities you can get is 90 of the purchase price ie. While 100 LTV mortgages are available for first-time buyers you can find far better and cheaper. Before you decide you should weigh the pros and cons of making a large down payment to see what is not only feasible for.

The scheme is expected to accept applications until 31 December 2022 however it may be withdrawn earlier. You can usually borrow as much as 80 or 85 of your equity depending on a few factors. You can apply for a mortgage under the scheme by following our usual application process.

Given the expensive price tag you must prepare a significant deposit to secure your mortgage. The amount you can borrow for your mortgage depends on a number of factors these include. For joint applications youll be eligible if at least one of you is a first time buyer.

Borrow more on your mortgage. VA Mortgage Calculator How Much Can I Afford with a VA Loan. The maximum amount you can borrow with a home equity loan depends on how much equity you have in your property.

We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home. 31000 23000 subsidized 7000 unsubsidized Independent. If youre planning to put down a deposit between 5 and 10 to qualify for the Mortgage Guarantee Scheme youll need to be.

The first step in buying a house is determining your budget. The idea of a 20 down payment can make homeownership feel unrealistic but the good news is that very few lenders still require 20 at closing. Our How much can I borrow.

Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. Your salary bill payments any additional outgoing payments including examples. Please get in touch over the phone or visit us in branch.

Factors that impact affordability. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage. Our free 55-page First-Time Buyers Guide talks you through everything you need to know from deposits to different types of mortgages and ways to boost your chances of mortgage acceptance.

Ally offers a HomeReady mortgage program that is geared toward low- to mid-income homebuyers regardless of whether its their first time or if theyre a repeat buyer that would allow them to put. This mortgage calculator will show how much you can afford. That said it may still make sense to pay the full 20 of the homes purchase price if possible.

When it comes to calculating affordability your income debts and down payment are primary factors. You can calculate your mortgage qualification based on income purchase price or total monthly payment. If youre a first-time homebuyer you are required.

Use the following calculator to determine the maximum monthly payment PI and the maximum loan amount for which you may qualify. Find out how much you can afford to borrow with NerdWallets mortgage calculator. Get a rough idea of how much you could borrow for a residential mortgage based on your personal circumstances.

One of the first steps in the homebuying process is determining your price range. Short Example of First time buyer mortgage. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. You can use the above calculator to estimate how much you can borrow based on your salary. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

We assume homeowners insurance is a percentage of your overall home value. Pensionretirement part-time income and bonuses if they are. 2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback.

How much mortgage you can borrow and how much mortgage you can afford are slightly different. You can use home equity loan proceeds for home repairs college costs emergencies and more. Total subsidized and unsubsidized loan limits over the course of your entire education include.

The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. We use current mortgage information when calculating your home affordability.

Casas En Phoenix Foreclosed Casas Remate Subasta De Casas En Phoenix Az Hablamos Espanol 623 First Time Home Buyers First Home Checklist Buying A New Home

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Home Mortgage

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Steps To Buying A House Buying First Home Home Buying Tips Buying Your First Home

Tips For First Time Home Buyers Applying For A Mortgage In 2022 Successful Business Tips Real Estate Quotes Home Buying Tips

Mortgage Tax Credit Recapture Mcc Nchfa Nc Mortgage Experts First Home Buyer Tax Credits First Time Home Buyers

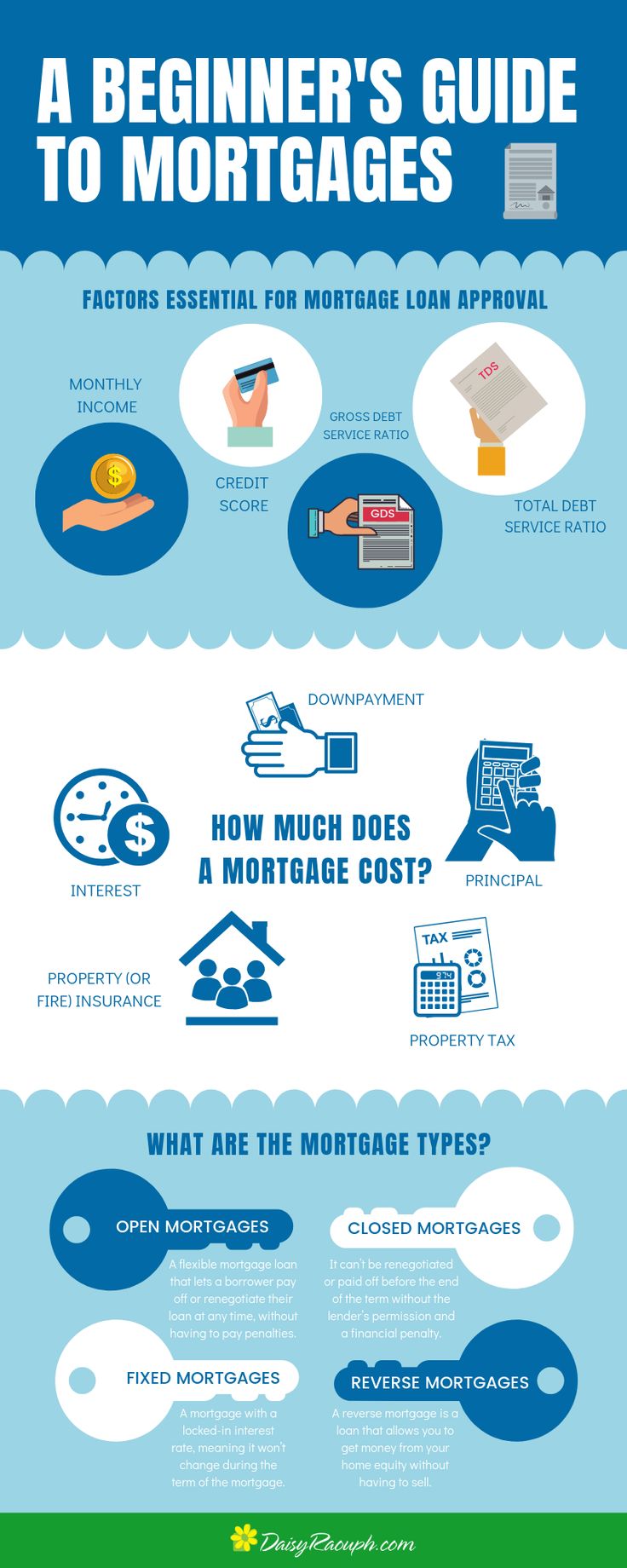

A Beginner S Guide To Mortgages Beginners Guide Mortgage Mortgage Loans

How Much House Can You Afford How To Find Out Budgeting Mortgage Tips

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

A Home Of Your Own Home Buying Living Room Accessories Living Room Theaters

115 Real Estate Infographics Use To Ignite Your Content Marketing Updated Buying First Home Real Estate Infographic Home Buying Tips

What Is Loan Origination Types Of Loans Personal Loans Automated System

The Keys To Home Affordability How Much You Can Borrow The Borrowers Real Estate News I Can

Options For First Time Homebuyers Home Buying First Time Home Buyers Home Buying Tips

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

Use The Interactive Home Loan Calculator To Calculate Your Home Loan Emi Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Payment Calculator